The US dollar is lower across the board on Tuesday. The market is navigating a perfect storm as the stock rally hit a speed bump at the same time geopolitical risk is on the rise. Multiple elections around the globe and trade concerns between big economies (China-US, EU and UK) have triggered risk aversion. Asset classes that had lost their safe haven appeal are back. Gold is having a moment as even the USD is not the final destination. Investors are dialling back their risk appetite and pulling out of stocks, flocking to traditional safe haven assets.

The Bank of Canada (BoC) will publish its benchmark rate on Wednesday, October 25 at 10:00 am EDT and will host a press conference with Governor Stephen Poloz at 11:15 am EDT.

- BoC expected to hike interest rate to 1.75%

- API crude inventory points to a buildup, but weather could play a factor

- Fed speakers to boost US dollar

Loonie Flat Awaiting BoC Rate Decision and Poloz Speech

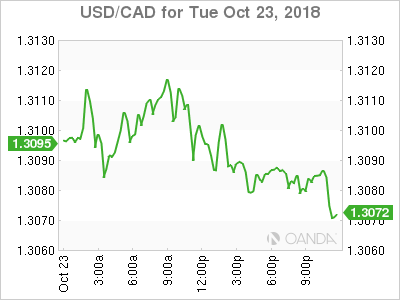

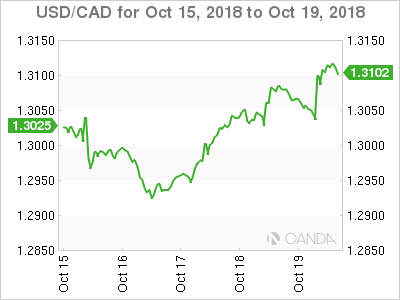

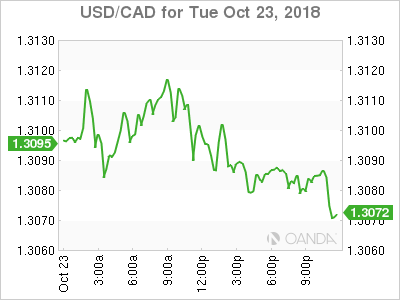

The USD/CAD lost 0.10 percent on Tuesday. The currency pair is trading at 1.3086 ahead of the Bank of Canada (BoC) rate announcement. The central bank is highly anticipated to lift interest rates to 1.75 percent. The move is for the most part priced into the loonie, but the press conference by Governor Stephen Poloz is what investors will be focusing on. The expectation is for a dovish hike, rising rates while at the same time highlighting the major headwinds facing the Canadian economy.

Inflation and retail sales disappointed, but still showed enough momentum behind the economy to validate a higher benchmark rate. The biggest factor keeping the BoC awake at night was the uncertain fate of NAFTA. Teh signing of the USMCA has taken that away, although ratification is still six months away.

The loonie is slightly higher ahead of the BoC, with risk appetite subdued as the global stock market sell off has safe havens bid. Geopolitics continue to be a major factor with currencies reflecting the market sentiment.

Euro Higher as US dollar Loses Footing

The EUR/USD is flat on Tuesday, but has accumulated 0.34 percent in losses this week. The single currency is trading at 1.1474 as the Italian budget continues to put downward pressure on the currency. The European commission has rejected the 2019 budget proposed by Italy with a three week period to submit a new one.

Italian politicians are sticking to their guns and the showdown between Rome and Brussels shows no sign of a reaching a middle ground.

The European Central Bank (ECB) will publish its monetary policy decision on Thursday, with no changes expected. The central bank is set to start hiking rates next summer, but higher spending from Italy could derail those plans.

GBP Rebounds on Irish Backstop Alternative

Sterling is higher against the US dollar on Tuesday, but continues to be under pressure raking up a 0.59 percent loss this week as Brexit turmoil puts pressure on the pound.

Risk aversion has made investors seek the safety of gold, the Japanese yen and the Swiss franc. Political uncertainty around PM Theresa May has also done the currency no favours.

The lockdown on the Irish border received some good news as the EU could offer a UK wide customs union and avoid a hard border between Northern Ireland and the Republic.

So far positive rhetoric has pushed the currency higher, but lack of details is a concern as being 90 or 95 percent close to a deal during a speech is not the same as being close to signing an agreement. The market is expecting details sooner rather than later as the deadline is fast approaching and without a backstop there can be no trade deal.

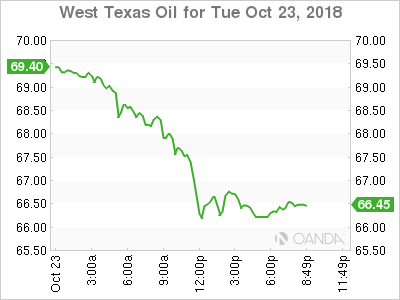

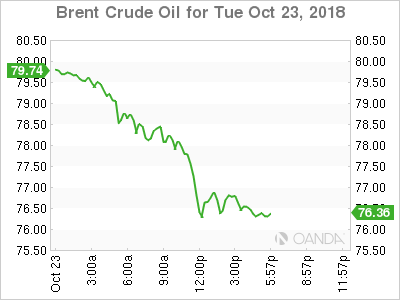

Oil Lower as Saudi Arabia Pledges to Close Production Gap

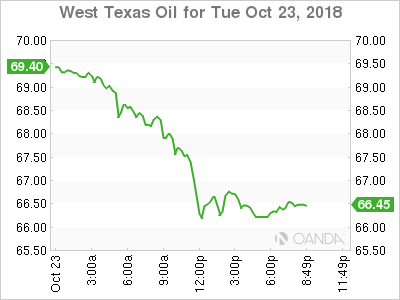

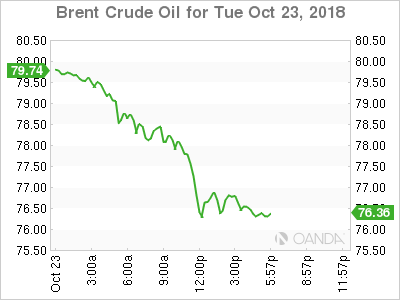

Oil is trading lower on Tuesday. West Texas Intermediate lost 4.56 percent as the Saudi Arabia investment conference drew to a close. Energy prices recorded a the biggest daily loss in three months as rising global growth concerns hit stock markets and demand for crude going forward.

Saudi Arabia has pledge it will increase production to keep prices stable and concerns of negative backlash following the killing of journalist Jamal Khashoggi have eased.

US sanctions against Iranian exports are providing some support but downward pressure has been more persistent. The release of the US weekly crude inventories published by the Energy Information Administration (EIA) on Wednesday could tip the balance, although the market has been pricing in a drawdown due to minor weather disruptions.

Geopolitics directly affecting the supply of oil was a big factor in October, but it now seems Saudi Arabia will increase production as much as possible sending energy prices lower.

Gold Higher on Safe Haven Demand

Gold rose 0.76 percent on Tuesday. The yellow metal was supported by a soft dollar and the stock market fall.

The market is in a perfect storm as the stock rally hit a speed bump at the same time geopolitical risk is on the rise. Multiple elections around the globe and trade concerns between big economies (China-US, EU and UK).

Investors are pulling back as stock market sell off has been the trigger. Asset classes that had lost their safe haven appeal are back. Gold is having a moment as even the USD is not the final destination. Investors are dialling back their risk appetite and pulling out of stocks, flocking to traditional safe haven assets.

The Trump tax cut boost is starting to fade and is being replaced by trade concerns are starting to hit companies. Caterpillar is citing rising costs and has underperformed. There is little hope the US-China trade dispute will end as quickly as the USMCA was signed.

The last quarter of 2018 will be packed with market events as central banks are expected to close out the year with major policy decisions and big political events (US midterms, Italian budget, Brazil elections, etc)

Market events to watch this week:

Wednesday, October 24

10:00am CAD BOC Monetary Policy Report

10:00am CAD BOC Rate Statement

10:00am CAD Overnight Rate

11:15am CAD BOC Press Conference

Thursday, October 25

7:45am EUR Main Refinancing Rate

8:30am EUR ECB Press Conference

8:30am USD Core Durable Goods Orders m/m

Friday, October 26

8:30am USD Advance GDP q/q

*All times EDT

For a complete list of scheduled events in the forex market visit the MarketPulse Economic Calendar