Die Privacy-Kryptowährung Monero hat mit einer Hard Fork “Bullet Proofs” eingeführt. Diese erste Implementierung einer neuen Kryptotechnologie ermöglicht es Monero, seine anonymen Transaktionen besser zu skalieren.

Am 18. Oktober hat die Kryptowährung Monero eine weitere reguläre Hardfork durchgeführt, um die Software zu aktualisieren. Das Upgrade zu Version 0.13.0.0., genannt “Beryllium Bullet“, war für die auf Privatsphäre konzentriere Währung ein Meilenstein, der demonstriert, welche Macht in einer Hardfork liegen kann.

Neben mehreren anderen Änderungen hat das Upgrade Bulletproofs eingeführt. Diese kryptographische Technologie gilt als wichtiger Schritt, um private Kryptowährungen zu skalieren. Es geht dabei um folgendes: Um die Privatsphäre der User zu schützen, verwendet Monero sogenannte “Confidential Transactions“. Dies ist eine Kryptotechnik, die den in einer Transaktion versendeten Betrag verschleiert, es den Knoten des Netzwerkes aber dennoch ermöglicht, zu prüfen, ob die Transaktion korrekt ist. Monero hat diese Technologie schon vor einiger Zeit implementiert, und gemeinsam mit den Ringsignaturen erreicht Monero damit einen sehr hohen, wenn nicht gar vollständigen Grad an Anonymität.

Das Problem ist aber: Confidential Transactions brauchen eine Form von Beweis, dass eine Transaktion nicht die Geldmenge manipuliert, indem sie etwa negative Beträge versendet. Logisch: Wenn man den Betrag einer Transaktion nicht kennt, ist dies schwierig, dies zu wissen. Bisher kamen hier sogenannte “Range Proofs” zum Einsatz. Mithilfe der Range Proofs kann man prüfen, ob der Inhalt einer Transaktion in einem bestimmten mathematischen Bereich liegt. Sie haben jedoch den Nachteil, dass sie recht groß sind und linear mit der Anzahl an Outputs und Bits des Bereichs skalieren.

Die Range Proofs machen eine einfache Monero-Transaktion etwa 13,2 Kilobyte groß. Dies erlaubt es in keinster Weise, die Kryptowährung auch nur im Ansatz zu skalieren. Eine Bitcoin-Transaktion ist nur 130-200 Byte groß; mit der derzeitigen Kapazität von Bitcoin könnte man kaum mehr als 85 Monero-Transaktionen in zehn Minuten prozessieren. Mehr als eine sehr kleine Nische lässt sich damit nicht bedienen.

Die Lösung für dieses Problem sind die sogennanten “Bullet Proofs“. Diese Technologie wurde von zwei Kryptographen der Universität Stanford gemeinsam mit Blockstream entwickelt. Dem Bullet-Proof-Algorithmus gelingt es, die Größe einer einfachen Monero-Transaktion auf 2,5 Kilobyte oder um 80 Prozent zu senken. Dies sollte, so die Erwartung, auch die mittlerweile drückenden Gebühren um 80 Prozent reduzieren.

Nachdem die Monero-Entwickler als erste eine Implementierung von Bullet Proofs begonnen und diese von externen Prüfern testen haben, hat Monero nun die neuen Proofs per Hardfork eingeführt - und damit ein wesentliches Hindernis für eine weitere Verbreitung von anonymen Krypto-Transaktionen deutlich reduziert. Der Erfolg übertrifft die Erwartungen sogar noch. Die durchschnittliche Transaktionsgröße fiel von 18,5 auf 3,7 Kilobyte, was tatsächlich einer Entlastung von 80 Prozent entspricht. Noch weiter fielen aber die Gebühren - nämlich von 60 auf 2 Cent, so zumindest ein Tweet von CoinMetrics.io.

Für Monero ist dies eine phantastische Nachricht. Zwar skaliert die Währung auch mit Bullet Proofs noch nicht richtig gut, aber immerhin würden in einen durchschnittlichen Bitcoin-Block von 1,5 Megabyte anstelle von etwa 85 nun 405 Transaktionen passen. Damit hat Monero die Menge seines speziellen Angebots - anonyme Transaktionen - mehr als vervierfacht.

Der Preis hat bisher aber kaum reagiert. So, als hätte es diese Meilenstein-Hardfork nie gegeben, bewegt sich der Monero-Preis weiterhin im Gleichschritt mit den anderen Coins. Eventuell zeigt dies einmal mehr, wie spekulativ die Kryptomärkte weiterhin sind.

The post Monero: Gebühren sinken dank Bullet Proofs um 97 Prozent appeared first on bitcoinmining.shop.

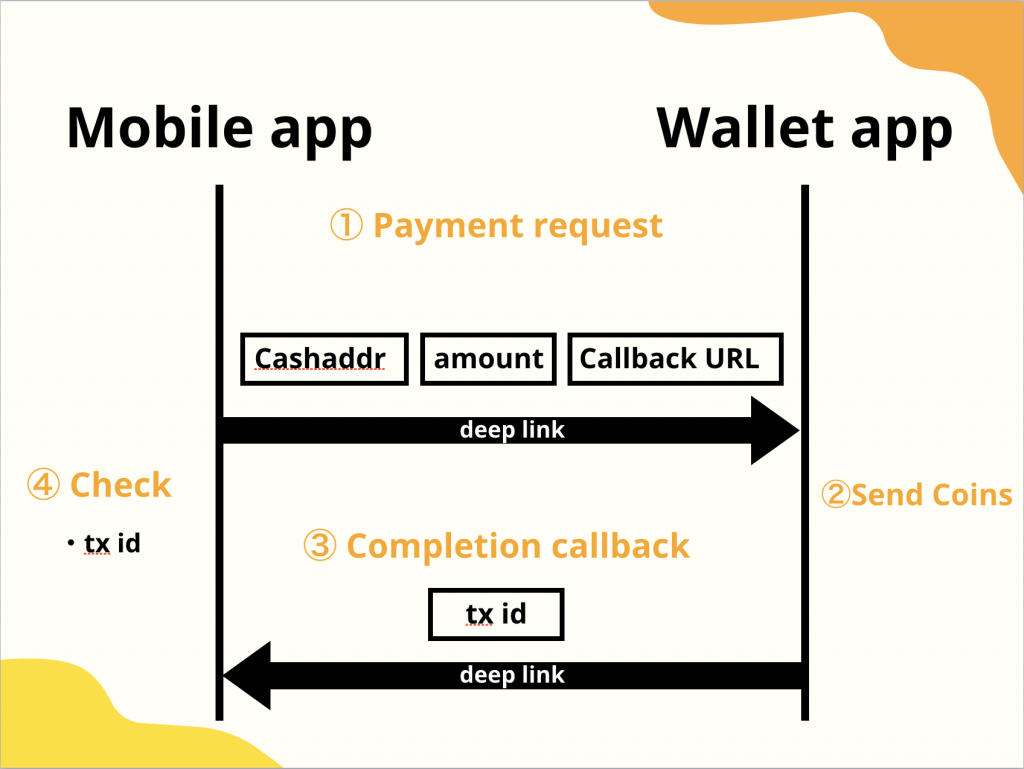

The DLPP specifications detail that the current experience with mobile wallets is not user-friendly and cryptocurrency payments take far more steps than they should. For instance, traditionally cryptocurrency wallet owners have to copy the address, open the wallet, paste the address, type the precise amount, and then authorize the payment. With the DLPP scheme, the payment link is opened inside the wallet software, and all the user has to do is confirm the payment. The Yenom developers believe the protocol is simple and an alternative design method similar to

The DLPP specifications detail that the current experience with mobile wallets is not user-friendly and cryptocurrency payments take far more steps than they should. For instance, traditionally cryptocurrency wallet owners have to copy the address, open the wallet, paste the address, type the precise amount, and then authorize the payment. With the DLPP scheme, the payment link is opened inside the wallet software, and all the user has to do is confirm the payment. The Yenom developers believe the protocol is simple and an alternative design method similar to