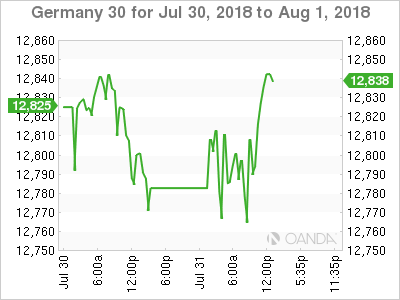

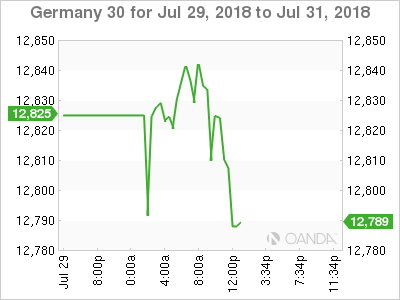

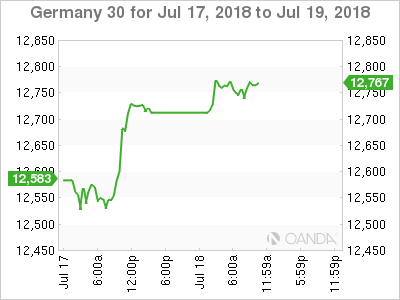

The DAX index is showing little movement in the Tuesday session. Currently, the DAX is at 12,808, up 0.08% on the day. In economic news, German retail sales rebounded with a gain of 1.2%, edging above the estimate of 1.1%. In the eurozone, CPI Flash Estimate edged up to 2.1%, above the forecast of 2.1%. Core CPI Flash Estimate gained 1.2%, above the forecast of 1.1%. Eurozone Preliminary Flash GDP dipped to 0.3%, shy of the estimate of 0.4%.

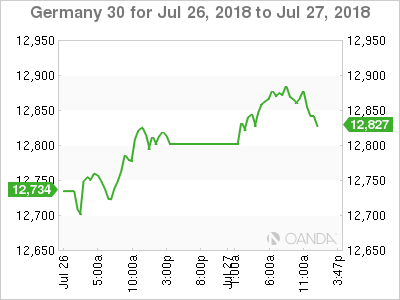

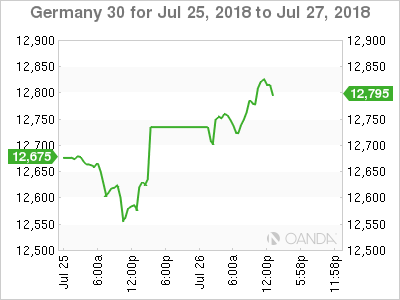

As the locomotive of Europe, Germany’s economic data is closely scrutinized by investors and is a bellwether of the health of the eurozone economy. Retail sales have shown mostly declines in 2018, pointing to weak consumer spending. However, after a sharp 2.1% decline in May, there was a strong rebound in June, with a gain of 1.2%. On Monday, Preliminary CPI improved with a gain of 0.3% in July, up from 0.1% a month earlier. The reading was just shy of the forecast of 0.4%. In the eurozone, the inflation estimate for July ticked higher, but the GDP gain of 0.3% was a disappointment. The reading missed the estimate and marked the smallest gain since Q3 of 2016. The eurozone economy hit some headwinds in the first quarter, but second-quarter data has been better and the ECB remains on track to wind up its bond-purchase program at the end of the year. The massive stimulus program gets mixed marks, as the eurozone economy is in a growth stage, but inflation remains well below the ECB target of just below the 2 percent level. On Wednesday, the focus will be on manufacturing PMIs, with both Germany and the eurozone expected to show stronger expansion in the July readings.

Commodities Weekly: No traction for commodities as the dollar softens

Economic Calendar

Tuesday (July 31)

- 2:00 German Retail Sales. Estimate 1.1%

- 3:55 German Unemployment Change. Estimate -10K

- 5:00 Eurozone CPI Flash Estimate. Estimate 2.0%

- 5:00 Eurozone Core CPI Flash Estimate. Estimate 1.0%

- 5:00 Eurozone Preliminary Flash GDP. Estimate 0.4%

- 5:00 Eurozone Unemployment Rate. Estimate 8.3%

*All release times are DST

*Key events are in bold

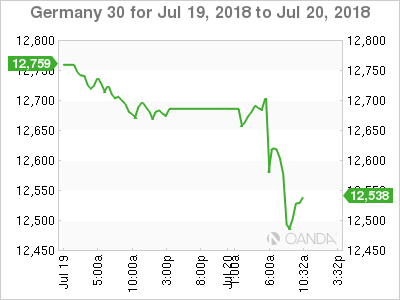

DAX, Tuesday, July 31 at 7:50 DST

Previous Close: 12,798 Open: 12,798 Low: 12,738 High: 12,826 Close: 12,808