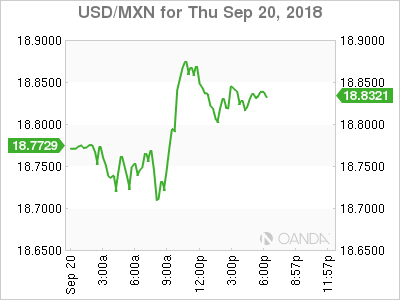

The US dollar was lower against most major pairs on Friday. The greenback dropped as investors flocked to safe havens away from the US currency. Trade war concerns and its impact on US companies have triggered a massive sell off in equities. The US dollar is on the back foot despite strong growth as evidenced by the release of the flash GDP for the third quarter that showed a 3.5 percent gain beating expectations.

The end of October and the start of November bring a packed weekly economic calendar. Central bank action and employment data will guide markets that are still sensible to geopolitics.

- Bank of Japan to avoid Halloween surprise

- Bank of England to keep monetary policy on hold until Brexit clarity

- US economy expected to have added 200,000 jobs in October

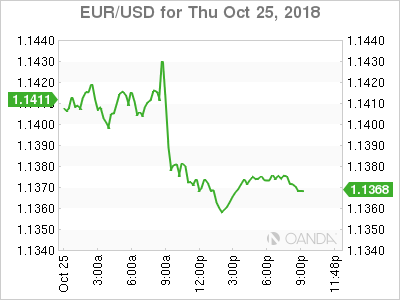

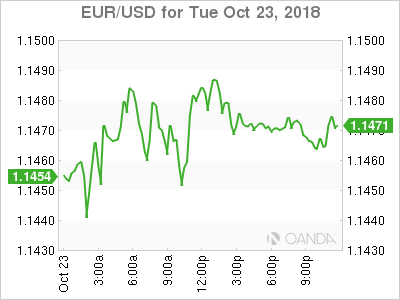

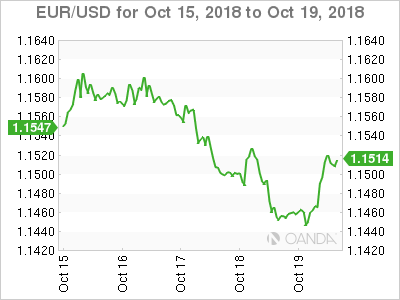

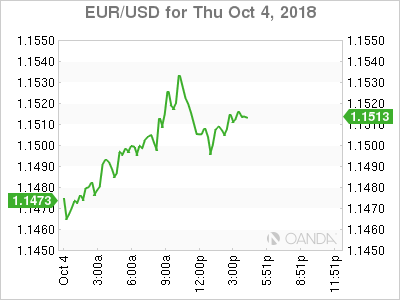

Euro to Underperform as Italian Budget Drama Continues

The EUR/USD lost 0.93 percent in the last five trading sessions. The single pair is priced at 1.1406 after a strong Friday saw funds exit the US dollar to look for safety elsewhere. European fundamentals make this a short term strategy as Italian budget concerns with neither side backing down, and the ongoing saga of Brexit negotiations are major headwinds for the currency.

Fears of an economic slowdown in the US proved to be premature, but investors worry that the boost from Trump tax cuts is evaporating. Stocks have been vulnerable as the U.S. Federal Reserve stands firm on its plans to hike one more time this year and three or four in 2019 on its path to rate normalization. US-China relations have not improved and earning reports have started to reflect the impact of tariffs on China.

The growth gap between US and Europe continues to widen, but for the most part has been already priced into the EUR/USD. The political situation where the European Council is opening too many fronts is a concerns for investors. Italy and the United Kingdom are asking for too much in the views of the EC, but it seems there is no clear middle ground in Italian budget negotiations or the trade deal after Brexit.

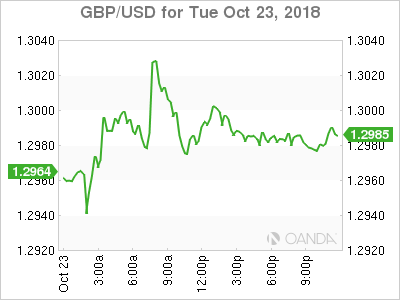

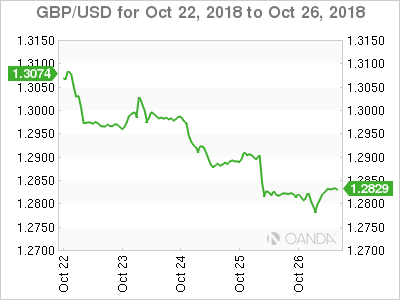

Brexit top of Mind for Sterling with BoE and Autumn Budget

The GBP/USD lost 1.97 percent during the week. Sterling is trading at 1.2832 versus the dollar. The equity market sell off did help the pound gain 0.11 percent on Friday. The risk event calendar in England is stacked with the Autumn Budget on Monday and the Bank of England (BoE) super Thursday not to mention the ongoing Brexit negotiations.

The lack of progress in the short term on Brexit will keep the BoE from making any changes to its monetary policy. A no-deal scenario is still very much alive and will limit what Governor Carney can propose, until those unknowns are sorted. The next rate hike in the UK could come until summer of 2019.

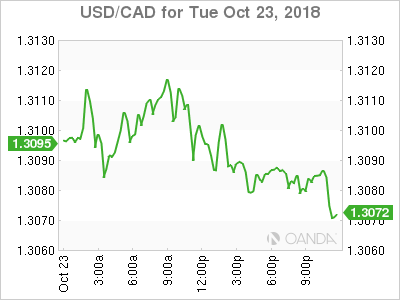

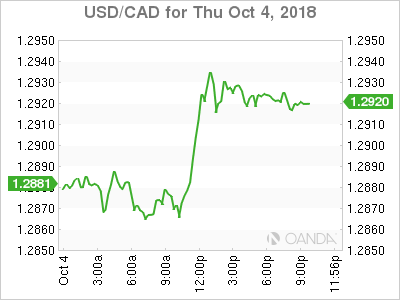

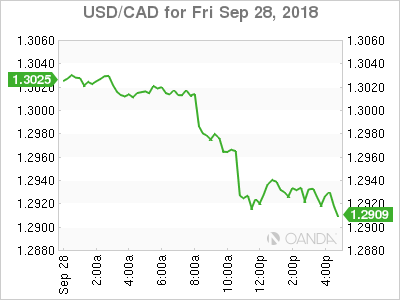

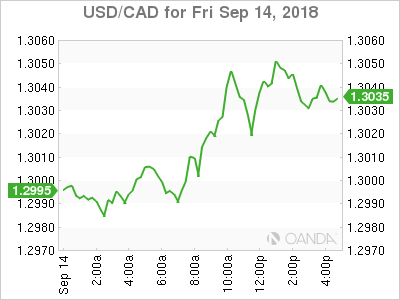

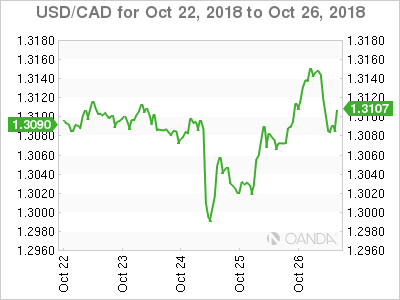

Stock Sell Off Puts Loonie Back in Defensive Mode

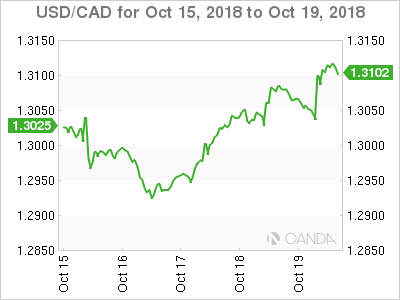

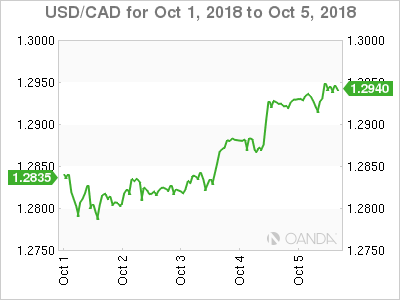

The Canadian dollar was the only major currency to not advance on the weakened dollar. The loonie lost 0.17 percent on Friday and with that would give back most of the gains earlier in the week and only end up 0.13 percent ahead of the greenback.

The Bank of Canada (BoC) delivered an expected 25 basis points rate lift on Wednesday, putting the currency pair near the 1.30 price level, but a combination of risk aversion and strong US data combined to once again put the loonie over 1.31 ahead of next week.

Employment data in the US and Canada will be the highlight for the pair. The US is forecasted to keep its steady pace of growth with employment its biggest pillar. The US could gain more than 200,000 jobs and wages see a rise of 0.2 percent, validating the Fed’s tightening policy and push the greenback higher.

Canadian jobs will prove crucial as the BoC was more hawkish than anticipated at its press conference following the rate hike announcement. Monthly GDP and raw material prices on Wednesday will precede the jobs announcement and together they will paint a clearer picture on the economy.

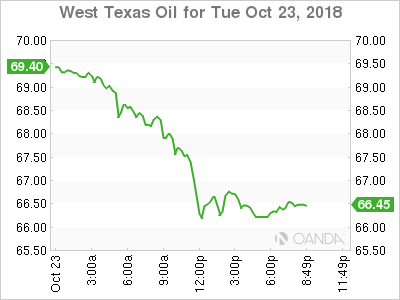

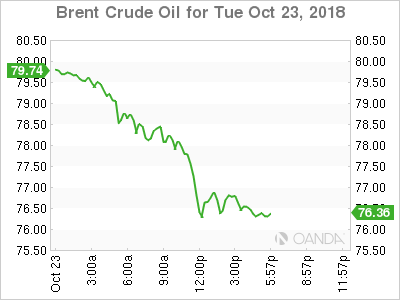

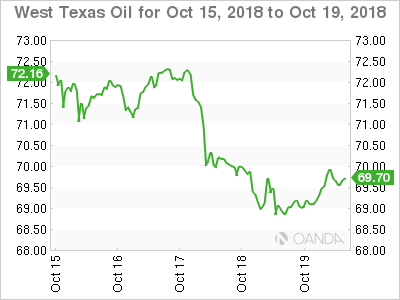

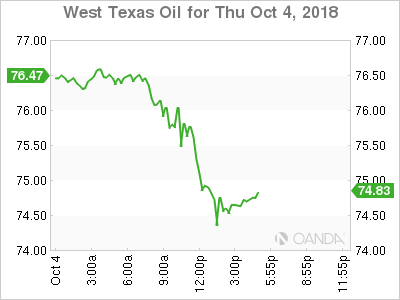

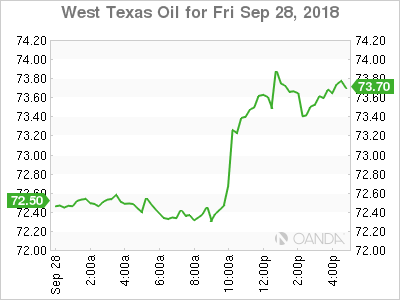

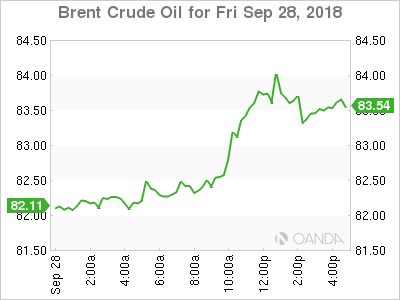

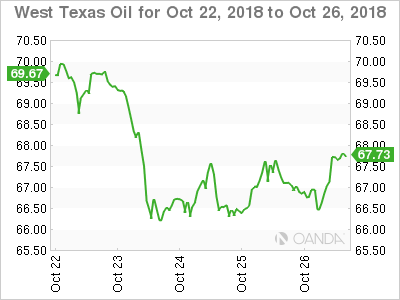

Oil Losses for Third Straight Week

Crude prices were higher on Friday but continue to fall as supply anxiety with conflicting Saudi Arabia comments and downward pressure from lower growth forecasts around the globe.

The equity market sell off also dictated the direction for oil to follow. Organization of the Petroleum Exporting Countries (OPEC) and other major producers are starting to worry about over supply as their production cut agreement is coming to and end, but as the same time global energy demand might be on the decline.

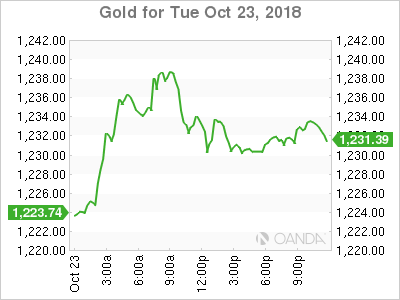

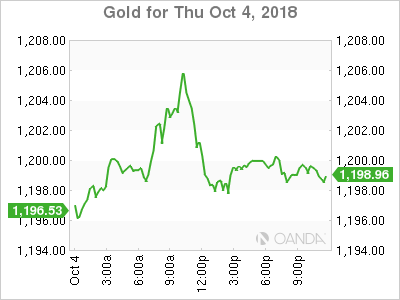

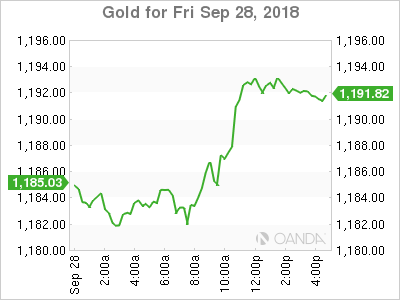

Gold Rises as Safe Haven Appeal Persists

Gold rose 0.28 on Friday as the stock market sell off hit the US dollar. US fundamentals continue to show a strong economy, but investors are still anxious about falling stocks and headed towards the safety of gold.

Gold has recouped its place as a safe haven after six months of losses. The Fed’s monetary policy and trade disputes have made stock markets drop and with investors liquidating long positions they have chosen the yellow metal as a destination. November if full of geopolitical risk events with US midterms, Italian budget and Brexit all in the agenda. Gold is expected to benefit from rising uncertainty, but is sensitive to a correction once the dust has settled.

Market events to watch this week:

Monday, October 29

8:30am USD Core Personal Consumption Expenditure

Tuesday, October 30

6:00am EUR Flash EU Gross Domestic Product

10:00am USD CB Consumer Confidence

8:30pm AUD CPI q/q

Tentative JPY BOJ Policy Rate

Tentative JPY Monetary Policy Statement

Tentative JPY BOJ Outlook Report

Wednesday, October 31

Tentative JPY BOJ Press Conference

6:00am EUR Flash EU CPI

8:15am USD ADP Non-Farm Employment Change

8:30am CAD GDP m/m

Thursday, November 1

5:30am GBP Manufacturing PMI

8:00am GBP BOE Inflation Report

8:00am GBP MPC Official Bank Rate Votes

8:00am GBP Monetary Policy Summary

8:00am GBP Official Bank Rate

8:30am GBP BOE Gov Carney Speaks

10:00am USD ISM Manufacturing PMI

8:00pm NZD ANZ Business Confidence

8:30pm AUD Retail Sales m/m

Friday, November 2

8:30am CAD Employment Change

8:30am CAD Trade Balance

8:30am CAD Unemployment Rate

8:30am USD Average Hourly Earnings m/m

8:30am USD Non-Farm Employment Change

8:30am USD Unemployment Rate

*All times EDT

For a complete list of scheduled events in the forex market visit the MarketPulse Economic Calendar